Some Known Incorrect Statements About Feie Calculator

Rumored Buzz on Feie Calculator

Table of ContentsThe Definitive Guide for Feie CalculatorThe Ultimate Guide To Feie CalculatorSome Ideas on Feie Calculator You Need To KnowThe Facts About Feie Calculator UncoveredEverything about Feie Calculator

Initially, he marketed his united state home to establish his intent to live abroad completely and requested a Mexican residency visa with his better half to assist satisfy the Authentic Residency Test. Furthermore, Neil protected a long-term residential property lease in Mexico, with plans to eventually acquire a residential property. "I currently have a six-month lease on a residence in Mexico that I can extend another six months, with the purpose to purchase a home down there." Neil directs out that buying residential property abroad can be challenging without initial experiencing the location."We'll absolutely be outside of that. Even if we come back to the United States for medical professional's consultations or business phone calls, I question we'll spend even more than 1 month in the United States in any type of provided 12-month period." Neil stresses the importance of strict tracking of U.S. brows through (Physical Presence Test for FEIE). "It's something that individuals require to be actually diligent about," he says, and advises expats to be cautious of common mistakes, such as overstaying in the united state

Feie Calculator - Truths

tax obligation obligations. "The reason that united state taxation on around the world earnings is such a big offer is because lots of people forget they're still subject to U.S. tax even after relocating." The U.S. is one of the couple of nations that taxes its citizens no matter where they live, suggesting that also if an expat has no income from united state

tax return. "The Foreign Tax Credit rating allows individuals working in high-tax nations like the UK to offset their U.S. tax obligation obligation by the amount they have actually already paid in tax obligations abroad," claims Lewis. This ensures that deportees are not tired twice on the same revenue. Nonetheless, those in low- or no-tax countries, such as the UAE or Singapore, face additional obstacles.

How Feie Calculator can Save You Time, Stress, and Money.

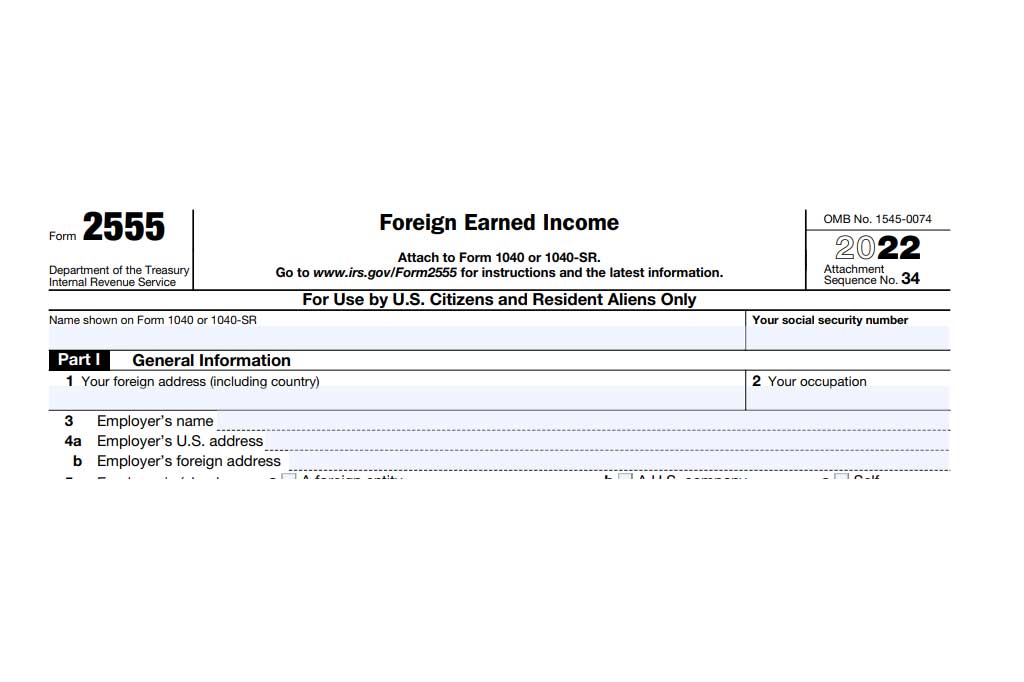

Below are some of one of the most often asked inquiries regarding the FEIE and various other exemptions The Foreign Earned Earnings Exclusion (FEIE) permits united state taxpayers to exclude approximately $130,000 of foreign-earned revenue from government earnings tax, reducing their U.S. tax liability. To receive FEIE, you have to meet either the Physical Existence Examination (330 days abroad) or the Authentic House Test (prove your key house in a foreign nation for a whole tax year).

The Physical Existence Examination additionally calls for United state taxpayers to have both an international earnings and an international tax obligation home.

Not known Facts About Feie Calculator

An income tax obligation treaty in between the U.S. and an additional country can assist protect against double tax. While the Foreign Earned Revenue Exclusion lowers gross income, a treaty might provide extra benefits for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Record) is a needed declaring for united state residents with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on conference particular residency or physical existence tests. He has over thirty years of experience and now specializes in CFO services, equity payment, copyright taxes, marijuana taxes and separation related tax/financial preparation issues. He is an expat based in Mexico.

The foreign earned income exclusions, often referred to as the Sec. 911 exclusions, exclude tax obligation on incomes gained from functioning abroad. The exemptions consist of 2 components - a revenue exemption and a real estate exclusion. The adhering to FAQs talk about the benefit of the exclusions consisting of when both partners are deportees in a basic manner.

The 9-Second Trick For Feie Calculator

The revenue exclusion is now indexed for rising cost of living. The optimal annual income exclusion is $130,000 for 2025. The tax obligation benefit omits the revenue from tax obligation at lower tax rates. Formerly, the exemptions "came off the check my source top" decreasing earnings based on tax obligation at the top tax rates. The exemptions may or may not decrease revenue made use of for various other purposes, such as individual retirement account limitations, youngster credit ratings, personal exceptions, and so on.

These exemptions do not spare the incomes from US tax yet just supply a tax reduction. Keep in mind that a single person functioning abroad for every one of 2025 who earned regarding $145,000 without other earnings will certainly have gross income decreased to absolutely no - properly the very same solution as being "tax obligation complimentary." The exemptions are calculated on a daily basis.